🥁 The Music Must Go On: Chain Abstraction in Web3

Sept 5th, 2024 - Welcome, let's dive in to today's news

GM Composers,

This is the third press release from the brand new Rhythm Report!

As always, It is our goal to bring you a quick and comprehensive rundown of the latest Crypto, Macro Market, and Symphony-Specific News.

Sounds good? Let’s get to it!

⏯️ Opening Act: Today's Top Crypto Hits

Uniswap Labs Reaches Settlement Agreement with CFTC

In a landmark decision impacting the decentralized finance (DeFi) sector, Uniswap Labs has agreed to pay a $175,000 settlement to the Commodity Futures Trading Commission (CFTC). The regulatory body charged Uniswap with offering illegal leveraged transactions and lacking sufficient controls to prevent unlawful derivative trading on its platform. This settlement underscores the growing scrutiny on DeFi activities by regulatory authorities.

However, the decision was not without controversy within the CFTC itself. Several commissioners voiced dissent, arguing that this action may establish a troubling precedent for decentralized platforms. They raised concerns about regulatory overreach, particularly questioning the appropriateness of the CFTC regulating platforms where developer control over user activities is limited.

Simultaneously, the legal battle between Ripple and the SEC continues to unfold, with both parties seeking a stay on the recent court judgment. The SEC intends to appeal the court's ruling which declared Ripple's cryptocurrency, XRP, not a security. This case is critical as it could significantly influence regulatory clarity for digital assets across the broader cryptocurrency industry.

Zurich Cantonal Bank Launches Crypto Trading Services

Zurich Cantonal Bank (ZKB), Switzerland’s fourth-largest bank with an impressive $450 billion in assets under management, has unveiled a new service allowing customers to trade Bitcoin ($BTC) and Ethereum ($ETH) directly through its e-banking and mobile platforms. This initiative highlights ZKB's ongoing commitment to blending traditional banking with the burgeoning field of digital currencies.

Clients of ZKB now have the ability to engage with the crypto markets by trading $BTC and $ETH, allowing both novice and experienced traders to participate directly through ZKB's trusted banking platforms.

In response to the crucial need for security in the crypto space, ZKB offers robust protection by securely storing clients' private keys. This service alleviates the technical challenges and security risks individuals might face when managing their own crypto wallets, making it easier for customers to invest in digital currencies without worrying about potential cyber threats.

Additionally, reflecting the non-stop nature of the cryptocurrency markets, ZKB ensures that its clients can trade digital assets 24/7. This constant access is essential for responding to market movements and opportunities that can arise at any time, day or night.

Furthermore, extending beyond its own client base, ZKB has partnered with other Swiss banks to provide similar crypto trading services. This cooperative approach fosters a broader adoption and integration of cryptocurrencies within the traditional banking sector in Switzerland.

ZKB isn’t new to the digital asset space. Since 2021, the bank has actively participated in pioneering projects like the issuance of the world’s first digital bond on the SIX Digital Exchange. This history showcases ZKB’s leading role and expertise in integrating digital solutions with conventional financial products.

With these advancements, Zurich Cantonal Bank is setting a benchmark in the financial industry by integrating innovative digital asset trading into its established banking services. This not only strengthens ZKB's position in the market but also enhances its clients' ability to diversify and secure their investment portfolios in the digital age.

🥁 Backstage Pass: Symphony Insights

Symphony Integrations on Full Speed

The Symphony ecosystem is growing more day by day. With already over 6 chains, 5 protocols, and already over 150 tradable assets (including forex 👀), Symphony is priming to disrupt perpetuals trading as we know it.

The Symphony ecosystem continues to expand, demonstrating remarkable growth each day. Presently, we have integrated over six chains and five distinct protocols, already supporting over 150 tradable assets (including forex 👀). This fast development highlights Symphony's commitment to reshaping the future of perpetual trading.

As Symphony grows, so does its capacity to innovate within the perpetuals market. By integrating forex trading, we are setting the stage for a unique blend of crypto and traditional financial trading elements. This integration not only diversifies trading options but also attracts a wider audience from various trading backgrounds, enhancing liquidity and market stability.

Can you guess who’s already integrated?

Symphony’s Market Size is Larger Than You Might Think

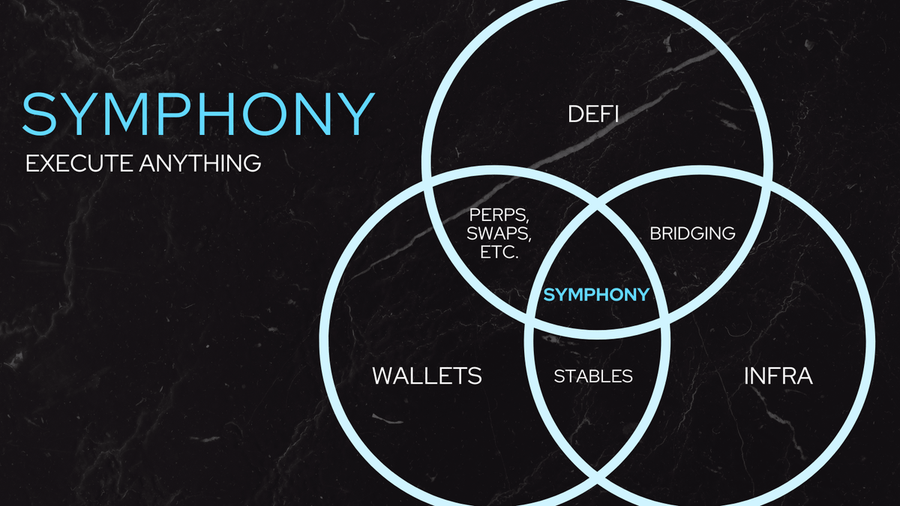

In the last year alone, an astounding 112.5 billion transactions were processed onchain—a figure that only hints at the potential of this market, especially considering the retail sector has yet to fully engage. Symphony is poised to not only handle this existing volume but to scale efficiently to accommodate even greater demand.

Let's delve deeper into the market dynamics at play. The onchain transaction market is already substantial, yet the majority of trading activity remains concentrated on centralized exchanges (CEXs). To put it into perspective, 95% of perpetual trade volume and 86% of swap transactions still occur on CEXs. This discrepancy points to a significant market opportunity for decentralized platforms.

Why is there such a vast imbalance in trading volume between CEXs and decentralized platforms? One major factor is user experience. Studies indicate that users will abandon an application within 15 seconds if they find it confusing. Unfortunately, many current crypto platforms are notoriously complex, requiring in-depth knowledge to navigate effectively and avoid financial pitfalls. This poor user experience drives many traders to continue using CEXs, despite the potential benefits of decentralized alternatives.

Currently, only 1% of trades are executed on decentralized perpetual protocols. However, if this could be increased, the potential market expansion would be immense. Symphony aims to revolutionize this space by simplifying onboarding processes, making it easier for users to transition to onchain solutions. But Symphony's ambitions don't stop at perpetual trades.

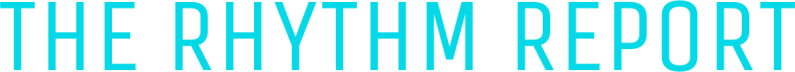

Built as a generalized infrastructure, Symphony's technology stack is designed to facilitate a broad range of onchain activities. In the near future, almost any transaction—from perp aggregation to lending, borrowing, bridging, swaps, NFT transactions, on-ramping/off-ramping, and much more—can be processed through Symphony. This not only opens new revenue streams for users and the protocol itself but also benefits nearly all other protocols by providing access to the fastest execution system in the crypto industry.

The potential for growth and innovation within crypto is enormous, touching various sectors and enhancing the overall efficiency and accessibility of the crypto ecosystem and promises a more inclusive and streamlined future for all.

See our latest thread for an overview of Symphony’s Market Size: https://x.com/CadenceProtocol/status/1829258259494236539

Exiting the Canto Ecosystem Update

As mentioned during our last AMA, we have now completed the process of removing our liquidity from the Canto Mainnet to migrate to Ethereum. This serves to deepen our liquidity on Uniswap and is another step in Phase 1 of Symphony.

Reminder that September 12th is the official Cadence Perps Sunset date. Anyone with trades live are encouraged to close them before then.

See our latest post about this: https://x.com/CadenceProtocol/status/1830666225678213552

🎻 Harmony in Tech: DeFi Innovation News

The Shift Toward Chain Abstraction

Chain Abstraction Explained

Chain abstraction represents a pivotal evolution in our modular blockchain ecosystem. Previously, modular designs enhanced scalability by optimizing individual blockchain components, which, while beneficial, led to a disjointed user experience across numerous new blockchain platforms.

Launching rollups and appchains has become increasingly accessible due to advancements in rollup frameworks and Rollup-as-a-Service (RaaS). This accessibility has significantly reduced transaction costs on Ethereum L1. However, the user experience on L2 solutions remains disparate compared to the cohesive experiences once found on platforms like Solana or Ethereum during the peak of DeFi summer in 2020.

The proliferation of new chains has fueled experimentation and expanded the rollup landscape, marking a promising but fragmented phase in blockchain's evolution.

Unifying the User Experience with Chain Abstraction

Chain abstraction is poised to revolutionize user interaction within crypto by harmonizing the scattered elements of DeFi and Web3 systems. Coupled with high-performance, intent-driven bridges and transport layers, the vision is a seamless, Web2-like onchain experience where browsing and interacting with decentralized apps (dApps) are as intuitive as navigating traditional websites.

Despite its potential, the concept of chain abstraction remains complex and underexplored. As pioneers in this space with Symphony, we hold a unique position to guide its development. Simplifying these concepts and showcasing their practical benefits are crucial for wider adoption and advancement in the industry.

Core Components of Chain Abstraction

Enhanced User Access

Wallet Integration: Simplifies managing assets across multiple chains by providing a unified wallet interface that aggregates token balances, improving user interactions.

Account Simplification: Improves security and ease of use in account management and transaction processing, critical for attracting and retaining blockchain newcomers.

Operational Efficiency

Transaction Orchestration: Facilitates the coordination of multi-chain operations, automating complex processes to deliver a seamless and error-free user experience.

Automated Commerce Solutions: Accelerates and secures transactions in blockchain commerce, integrating smoothly with crypto and fiat systems to enhance business operations.

Optimization of Transactions

Order Management: Enhances trading outcomes by routing orders through diverse liquidity sources, both on-chain and off-chain, to secure optimal trading conditions.

Solver Enhancement: Leverages external solvers for complex tasks like transaction validation and pricing, improving network performance and dependability.

Interconnectivity and Standards

Interoperability Protocols: Implements standards such as ERC-7281, ERC-7683, and ERC-4337 to facilitate seamless cross-chain interactions, enhancing user experiences and expanding blockchain functionality.

Advanced Infrastructure

Settlement Innovations: Introduces technologies that accelerate the finality of transactions, enhancing both the reliability and speed of blockchain operations across various platforms.

Conclusion: Reassembling the Blockchain Puzzle

Whereas modularity deconstructed traditional blockchain structures, chain abstraction aims to reassemble these components into a more integrated and accessible system.

As we push forward with these technological advancements, they promise to transform the blockchain landscape into a more unified and user-friendly network. This phase of integration is critical as we strive to refine and broaden the blockchain's capabilities, paving the way for a streamlined and interconnected future with Symphony at the helm.

DeFi Insights

Ethereum Foundation - Treasury Management Transparency Issues - Read

The Ethereum Foundation is currently facing scrutiny over its treasury management practices after an onchain transfer of 35,000 ETH ($94 million) to Kraken was detected last Saturday, highlighting concerns regarding transparency.

EOS - Launch of Spring 1.0 - Read

Yesterday marked the go-live of the Spring 1.0 release for EOS, bringing new features and enhancements to the platform.

Mantle - Expansion onto Odos Exchange - Read

Mantle is now available on the Odos exchange, expanding its accessibility and utility in the Layer 2 ecosystem.

Alora - Partnership with Berachain - Read

Alora announces a new strategic partnership with Berachain, aiming to leverage AI technologies within the blockchain sector.

Perennial (DeFi) - Market Migration - Read

Perennial will close its Matic market and transition to a new setup on Pol, streamlining its offerings and enhancing user experience.

Nvidia - Antitrust Investigation Escalation - Read

Nvidia receives a subpoena as part of an expanding antitrust investigation, signaling increased regulatory scrutiny.

Samsung Next - Investment in Startale -Read

Samsung Next makes a strategic investment in Startale, supporting innovation and growth in blockchain technologies.

🎉 Festival Highlights: Upcoming Events

We will be attending Token2049 this year! Come meet the team if you are in Singapore!

We are looking for Advanced Top Traders who are interested in seeing Symphony’s tech firsthand and providing feedback. If this is you, please reach out to any of the team on the Symphony discord or telegram!

🎶 Founders Notes

Vivaldi - “Just saw Mozart 10x lev long the Canadian dollar ($CAD) on Symphony” — X Post

Chopin - “We at Symphony are pioneering chain abstraction for executions but just wait until you hear about chain-agnostic infra.” — X Post

🎸 Don’t be just a Groupie, Join the Band

Follow The Rhythm Report on Twitter

Follow Cadence Protocol on Twitter

Join the Cadence Discord

Join the Official Telegram